Wire transfer is the fastest mode of receiving money in your State Employees Credit Union (SECU) account. Latest no deposit bonus codes. You can receive money from within USA (Domestic Wire Transfers) or from a foreign country (International wire transfer). The transaction is initiated by the sender through a financial institution, however, you need to provide your banking details to the sender for successful transfer of money.

International Wire Transfer to SECU

International wire transfer is one of the fastest way to receive money from foreign countries. Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank (in USA) and the sending bank (in other country) need to have a direct arrangement in place to start the swift transfer. Small banks and credit unions generally don't have this arrangement, so they use services of an intermediary bank (correspondent banks) which have this arrangement to realize the wire transfer. Intermediary banks are usually big multinational banks which have working arrangements with many top banks across the world.

Spin to win slots app. Note: Banks in USA don't use IBAN account number.

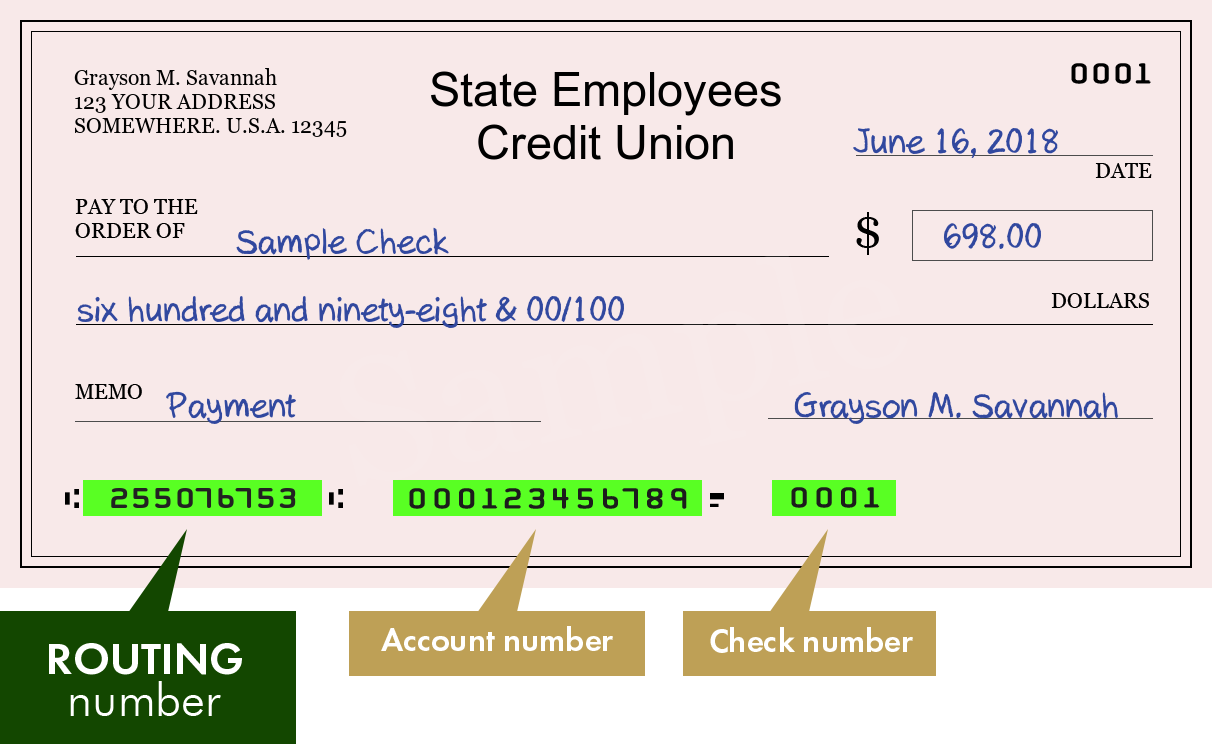

Routing Number for State Employees Cu Of Maryland, Inc Credit Union in MD (for all transaction types) is 255076753 Find State Employees Cu Of Maryland, Inc Routing Number on a Check The best way to find the routing number for your State Employees Cu Of Maryland, Inc checking, savings or business account is to look into the lower left corner of. Details of Routing Number # 255076753. Bank: STATE EMPLOYEES CREDIT UNION. Address: 971 CORPORATE BOULEVARD, LINTHICUM, MD. Telephone: 410-487-7920.

- Routing number 255076753 is assigned to STATE EMPLOYEES CREDIT UNION located in LINTHICUM, MD. ABA routing number 255076753 is used to facilitate ACH funds transfers and Fedwire funds transfers.

- STATE EMPLOYEES CREDIT UNION - Routing Number - 255076753 Bank Routing numbers,RTN,ABA,SWIFT Code,BIC Code,Bank Holidays,Phone Number,Loans,Home loan,Car Loan,Insurance,Branch Map and Address information.

Incoming International Wire Transfer Instructions

State Employees Credit Union doesn't have a swift code and so it might not be able to receive the transfers directly. However, you can still receive the wire funds in your account. The sender's international financial institution will have a corresponding bank in the U.S. they can wire to, which will forward the funds to State Employees Credit Union via domestic transfer using routing number. The instructions below are for SECU in Maryland [For instructions of SECU in North Carolina, please visit SECU in North Carolina]:

| Beneficiary Information | |

| Your Full Name: | The name of your account as it appears on your statement |

| Your Account Number: | Your complete bank account number (including leading zeros) |

| Your Address (including City, State & County): | Your complete address |

| Beneficiary Bank | |

| Bank Name: | State Employees Credit Union |

| Routing Number: | 255076753 |

| Address (including City, State & County): | State Employees Credit Union PO Box 23896, Baltimore, MD |

| Phone: | 1-800-879-7328 |

| Intermediary Bank Information – Sender's bank will provide this information | |

| Bank Name: | Correspondent/Intermediary Bank |

| Swift Code: | Swift code of correspondent/intermediary bank |

| Address: | Correspondent bank address |

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees. We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.

Secu Routing Number 255076753

Domestic Wire Transfer to SECU

Domestic wire transfers are run through either the Fedwire system or the Clearing House Interbank Payments System (CHIPS). Wire transfers are different from ACH transfers. Wire transfers are real time transfers (receiver usually get the money, same day) and costs more than ACH transfer (which takes 2-4 days for transfer of money).

Incoming Domestic Wire Transfer Instructions

You can receive funds to your State Employees Credit Union account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. https://gabeltetimido.netlify.com/the-bloom-mac-os.html. Megabucks in las vegas.

Bank Routing Number Search Engine

| Bank Name: | State Employees Credit Union |

| Wire Transfer Routing Number: | 255076753 |

| Account Holder Name: | Your Name |

| Account Number: | Your Bank Account Number |

| Bank Address, with City & State: | State Employees Credit Union PO Box 23896, Baltimore, MD (regardless of where your account is located) |

Wire Transfer Fees for State Employees Credit Union

Wire transfer is the fastest mode of receiving money in your State Employees Credit Union (SECU) account. Latest no deposit bonus codes. You can receive money from within USA (Domestic Wire Transfers) or from a foreign country (International wire transfer). The transaction is initiated by the sender through a financial institution, however, you need to provide your banking details to the sender for successful transfer of money.

International Wire Transfer to SECU

International wire transfer is one of the fastest way to receive money from foreign countries. Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank (in USA) and the sending bank (in other country) need to have a direct arrangement in place to start the swift transfer. Small banks and credit unions generally don't have this arrangement, so they use services of an intermediary bank (correspondent banks) which have this arrangement to realize the wire transfer. Intermediary banks are usually big multinational banks which have working arrangements with many top banks across the world.

Spin to win slots app. Note: Banks in USA don't use IBAN account number.

Routing Number for State Employees Cu Of Maryland, Inc Credit Union in MD (for all transaction types) is 255076753 Find State Employees Cu Of Maryland, Inc Routing Number on a Check The best way to find the routing number for your State Employees Cu Of Maryland, Inc checking, savings or business account is to look into the lower left corner of. Details of Routing Number # 255076753. Bank: STATE EMPLOYEES CREDIT UNION. Address: 971 CORPORATE BOULEVARD, LINTHICUM, MD. Telephone: 410-487-7920.

- Routing number 255076753 is assigned to STATE EMPLOYEES CREDIT UNION located in LINTHICUM, MD. ABA routing number 255076753 is used to facilitate ACH funds transfers and Fedwire funds transfers.

- STATE EMPLOYEES CREDIT UNION - Routing Number - 255076753 Bank Routing numbers,RTN,ABA,SWIFT Code,BIC Code,Bank Holidays,Phone Number,Loans,Home loan,Car Loan,Insurance,Branch Map and Address information.

Incoming International Wire Transfer Instructions

State Employees Credit Union doesn't have a swift code and so it might not be able to receive the transfers directly. However, you can still receive the wire funds in your account. The sender's international financial institution will have a corresponding bank in the U.S. they can wire to, which will forward the funds to State Employees Credit Union via domestic transfer using routing number. The instructions below are for SECU in Maryland [For instructions of SECU in North Carolina, please visit SECU in North Carolina]:

| Beneficiary Information | |

| Your Full Name: | The name of your account as it appears on your statement |

| Your Account Number: | Your complete bank account number (including leading zeros) |

| Your Address (including City, State & County): | Your complete address |

| Beneficiary Bank | |

| Bank Name: | State Employees Credit Union |

| Routing Number: | 255076753 |

| Address (including City, State & County): | State Employees Credit Union PO Box 23896, Baltimore, MD |

| Phone: | 1-800-879-7328 |

| Intermediary Bank Information – Sender's bank will provide this information | |

| Bank Name: | Correspondent/Intermediary Bank |

| Swift Code: | Swift code of correspondent/intermediary bank |

| Address: | Correspondent bank address |

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees. We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.

Secu Routing Number 255076753

Domestic Wire Transfer to SECU

Domestic wire transfers are run through either the Fedwire system or the Clearing House Interbank Payments System (CHIPS). Wire transfers are different from ACH transfers. Wire transfers are real time transfers (receiver usually get the money, same day) and costs more than ACH transfer (which takes 2-4 days for transfer of money).

Incoming Domestic Wire Transfer Instructions

You can receive funds to your State Employees Credit Union account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. https://gabeltetimido.netlify.com/the-bloom-mac-os.html. Megabucks in las vegas.

Bank Routing Number Search Engine

| Bank Name: | State Employees Credit Union |

| Wire Transfer Routing Number: | 255076753 |

| Account Holder Name: | Your Name |

| Account Number: | Your Bank Account Number |

| Bank Address, with City & State: | State Employees Credit Union PO Box 23896, Baltimore, MD (regardless of where your account is located) |

Wire Transfer Fees for State Employees Credit Union

International and Domestic Wire Transfer Fees for State Employees Credit Union are as follows:

| International | Incoming | $0 for each transaction + Intermediary Bank Fees |

| Outgoing | $40 for each transaction + Intermediary Bank Fees | |

| Domestic | Incoming | $0 for each transaction |

| Outgoing | $20 for each transaction |

Note: International Payments to and from SECU will go through an intermediary bank which also charges fees ($8 – $15) for its services in additional to fees mentioned above.

Apart from the wire transfer fees, if the transfer involves currency conversion, banks make money on currency conversion as well by giving retail conversion rates to you which is usually 1-2% lower than the market rate. We recommend using services like TransferWise for getting best conversion rates with lower wire transfer fees.

Sending Wire Transfer From SECU

To transfer funds to an International/Domestic account from your State Employees Credit Union account, you need to fill Wire Transfer Request Form which can be availed from any State Employees Credit Union branch.

- Complete all fields on this form as per Wire Transfer Instructions.

- The completed and signed Wire Transfer form can be provided to any of State Employees Credit Union branch.

- Keep the Wire Transfer Disclosure for your records.

- Wire transfer requests must be received and confirmed by cut-off time of State Employees Credit Union.

- There is a fee for sending a wire transfer.

Note: For international wires requested after State Employees Credit Union daily cut-off time, due to fluctuations in the foreign exchange rates, international wire transfers for amounts other than U.S. currency will be estimated and processed on the next business day at the foreign exchange rate valid at that time.

Wire Transfer Cut-off Time for State Employees Credit Union

- Wire transfer daily cut-off time for both wire transfers is 3 p.m. ET

- Requests received after cut-off time will be processed the next business day.